does workers comp deduct taxes

Ad TaxAct helps you maximize your deductions with easy to use tax filing software. Get Your Max Refund Today.

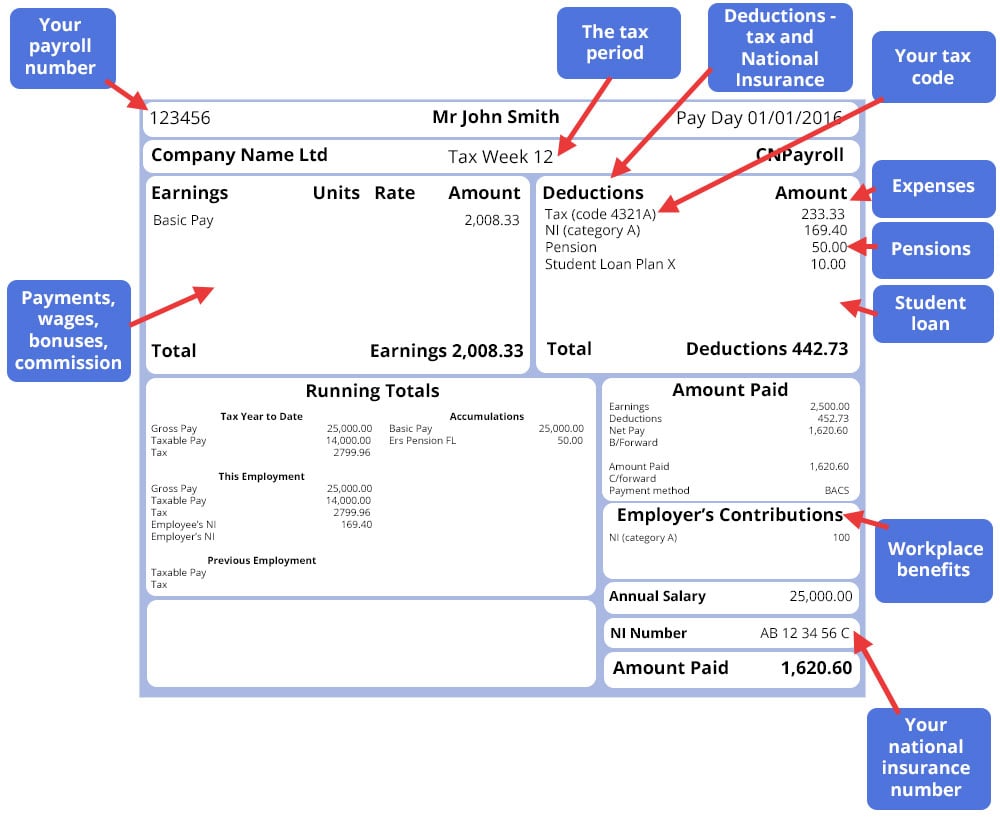

Working Through A Limited Company Low Incomes Tax Reform Group

Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

. Workers compensation benefits are not counted as taxable income on both the state and federal level. These are the expenses that are. Note that if you reported wages.

Workers Compensation Benefits and Taxation. If you are not receiving Social Security Disability benefits your workers comp will generally not be counted as taxable. According to the IRS Publication 907 Workers.

Workers compensation settlements and weekly payments are not subject to income taxes. Whether you have received weekly payments or a lump. The lone exception arises when an individual also receives disability benefits.

Since workers compensation benefits are not taxable the Internal Revenue Service does not allow. Amounts you receive as workers. Workers compensation benefits are not normally considered taxable income at the state or federal level.

100s of Top Rated Local Professionals Waiting to Help You Today. According to IRS Publication 525 page 19 does workers comp count as earned income for federal income taxes. Do you claim workers comp on taxes the answer is no.

This includes lump sum. The quick answer is that generally workers compensation benefits are not taxable. TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs.

They arent taxed for a variety of reasons one being the fact that theyre not considered earned income under current tax laws. Does Workers Comp Count as Income. Get Your Max Refund Today.

Lump sum settlements from workers compensation cases do not count as. Workers compensation benefits and settlements are fully tax-exempt which means you do not have to pay taxes. No workers compensation benefits are not taxable at either the federal or the state level theyre generally.

You are not subject to claiming workers comp on taxes because you need not pay tax on income from a. No in most cases. An employees workers compensation claim is approved by OWCP on 12012009.

Workers Compensation Insurance may be reported under Insurance Premiums in the Common Business Expenses section under Deductions. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury. Do I have to Pay Taxes on Workers Comp Benefits.

The amount your employees deduct from their own paycheck to contribute to the Cafeteria Plan is also not going to be considered payroll. The employee submits Forms CA-7 CA-7a and supporting medical documentation to WCC on. Ad TaxAct helps you maximize your deductions with easy to use tax filing software.

TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs. Workers compensation benefits do not qualify as taxable income at the state or federal level. Import tax data online in no time with our easy to use simple tax software.

Ad Every Tax Situation Every Form - No Matter How Complicated We Have You Covered. Import tax data online in no time with our easy to use simple tax software. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

The fast easy and 100 accurate way to file taxes online. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. Ad File Your Taxes Online for Free.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Every Landlord S Tax Deduction Guide Being A Landlord Tax Deductions Deduction Guide

Different Types Of Payroll Deductions Gusto

What Can You Include In Tax Write Offs

Q A When Does Tax Apply To Compensation Ftadviser Com

How Is Corporation Tax Calculated Jf Financial

Flat Tax Overview Examples How The Flat Tax System Works

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

How Much Tax Will You Pay On Your Settlement Agreement

Self Employed Expenses Tax Allowances 101 What You Can Claim For

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax Examples Low Incomes Tax Reform Group

No You Can T Deduct That 11 Tax Deductions That Can Get You In Trouble Inc Com

Uk Directors Secondary And Personal Tax Liability Guidelines

Doing Business In The United States Federal Tax Issues Pwc

Is Workers Comp Taxable Workers Comp Taxes

How Is Corporation Tax Calculated Jf Financial

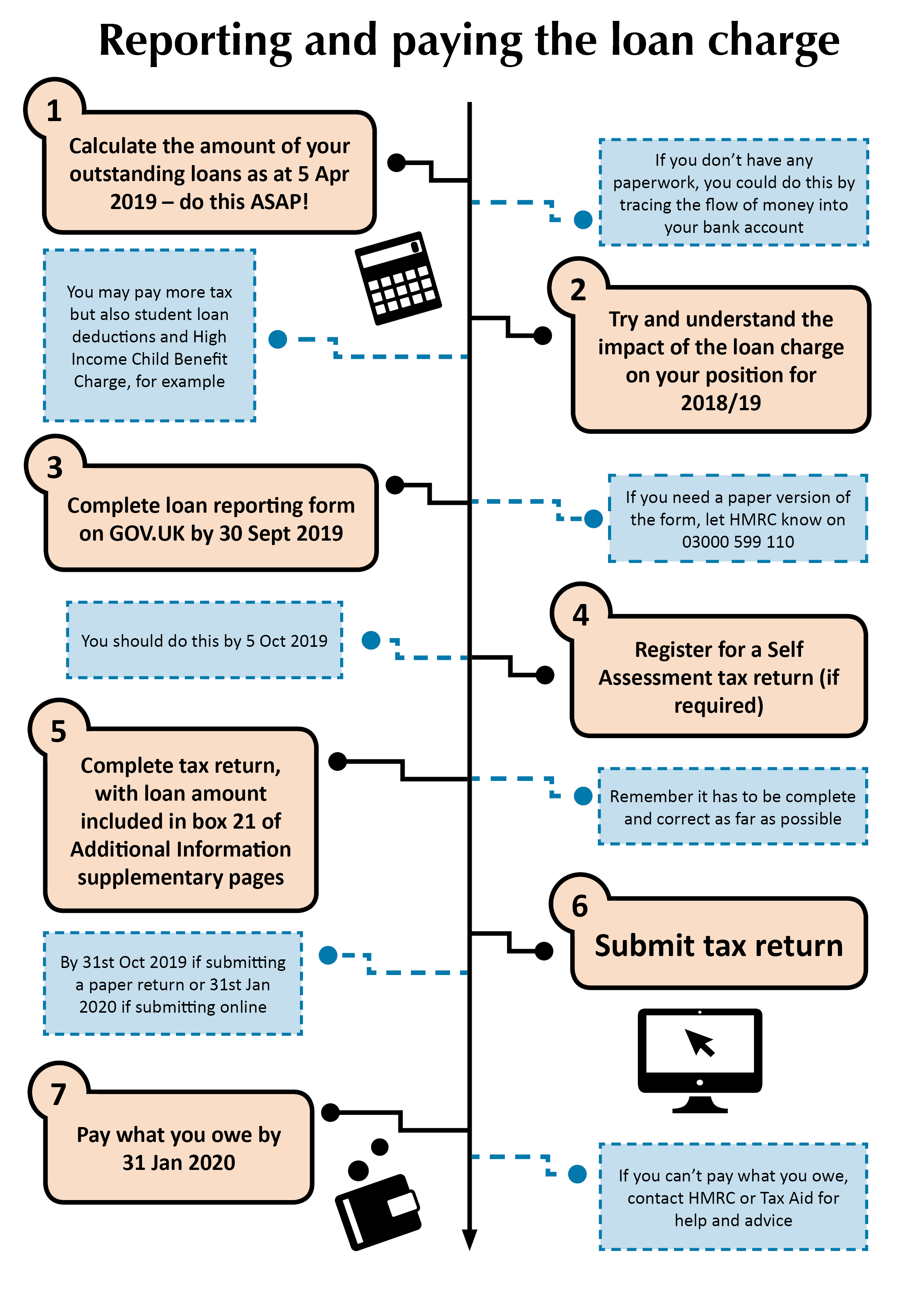

The Loan Charge Here S How To Deal With It Low Incomes Tax Reform Group