child tax credit september 2020

The IRS will use your 2020 or 2019 tax return whichever is filed later or information you previously entered using the non-filer tool to determine your eligibility for the child tax credit payments. This first batch of advance monthly payments worth.

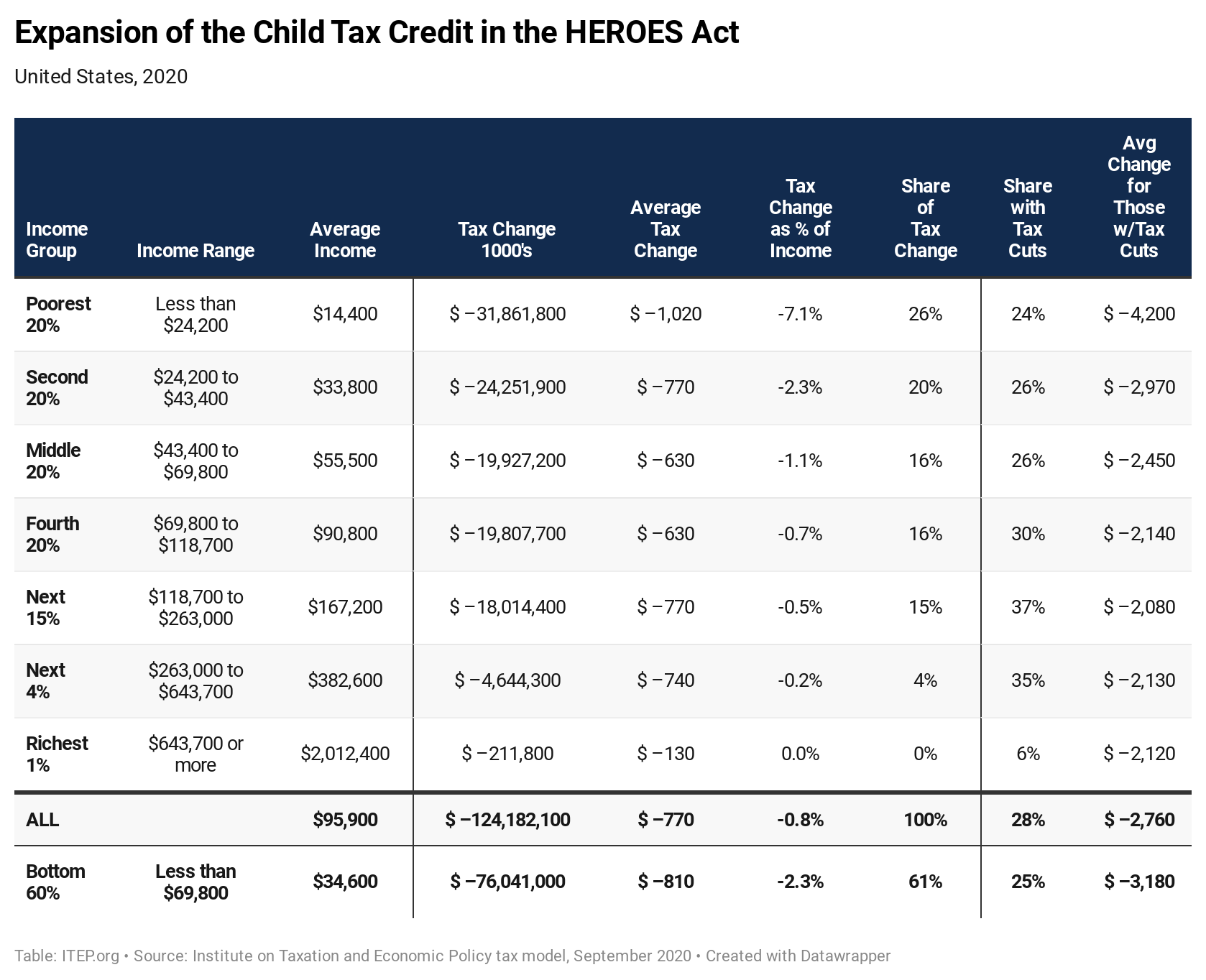

New Itep Estimates On Biden S Proposal To Expand The Child Tax Credit Itep

The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040.

. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. With TurboTax Its Fast And Easy To Get Your Taxes Done Right. In previous years 17-year-olds werent covered by the CTC.

There are a number of changes to the CTC in 2021 because of the American Rescue Plan Act of 2021 which President Biden signed into law on March 11 2021. The IRS said that qualified families who missed their child tax credit installments in September should get the funds in the coming days through direct transfer or payment. September 27 2021.

Instead of calling it may be faster to check the. Filemytaxes November 30 2021 Child Tax Credit Tax Credits. Child Tax Credit.

Millions of Americans dont care when the tax season begins or ends because they dont have to file taxes. This is a significant increase. There is also a 300 credit for non-child dependents available to.

September 15 2021 at 156 pm. AGI as reflected on. Users will need a.

Whether you can claim the person as a dependent. The 2020 Federal Adoption Tax Credit is worth as much as 14300 per child which can certainly ease the financial burden of adopting which anyone whos done it can tell you its not cheap. The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments.

Taxpayers may be able to claim the child tax credit if they have a qualifying child under the age of 17. The persons date of birth. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17.

With the Additional Child Tax Credit up to 1400 of the 2020 credit is refundable meaning that if it exceeds your income tax liability for the year the IRS will issue a refund check for the difference. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. Thats an increase from.

IR-2021-188 September 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September. Here is some important information to understand about this years Child Tax Credit. This interview will help you determine if a person qualifies you for the Child Tax Credit or the Credit for Other Dependents.

IR-2021-153 July 15 2021. The second phaseout can reduce the remaining Child Tax Credit below 2000 per child. Eligible families can receive a total of up to 3600 for each child under 6 and up to 3000 for each one age 6 to 17 for 2021.

Thats up to 7200 for twins This is on top of payments for. Canada child benefit CCB Includes related provincial and territorial programs. September Payments Arriving In Parents Bank Accounts.

Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their. The taxpayers qualifying child must have a Social Security number issued by the Social Security Administration before the due date. The Child Tax Credit is intended to offset the many expenses of raising children.

Get Your Max Refund Today. It also made the. On the other hand you can still file your taxes if you want to.

In addition the qualifications for the child tax credit have broadened meaning more families can now qualify that previously could not. Heres how to track the delayed Child Tax Credit. The first phaseout can reduce the Child Tax Credit to 2000 per child.

The child tax credit has increased from 1000 to 2000 per child maximum of 3 for families with children. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. The Child Tax Credit can be worth as much as 3500 per child for Tax Year 2021.

If you are someone who has little to no income youre under no obligation to file a Federal tax return. That is the first phaseout step can reduce only the 1600 increase for qualifying children ages 5 and under and the 1000 increase for qualifying children ages 6 through 17 at the end of 2021. It could also be that you received advance Child Tax Credit payments last year.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. For Tax Years 2018-2020 the maximum refundable portion of the credit is 1400 equal. Dont assume you cant qualify for the refundable credit just because you didnt qualify in prior years.

The amount of credit actually increased for 2021 up to 3600 for children under 6 and up to 3000 for those between 6 and 17 but those payments were advances of the credit that you would normally receive on your tax return. The Child Tax Credit provides money to support American families. IRS Tax Tip 2020-28 March 2 2020.

The expansion of the child tax credit meant millions of American families began receiving payments last month. Part of this credit can be refundable so it may give a taxpayer a refund even if they dont owe any tax. Theres a small but possibly important.

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Here S What You Need To Know About Child Tax Credit Payments The Washington Post

Existing Home Sales September 2020 Tampa Real Estate Real Estate Real Estate Information

My Top Tips To Help You Save Money Tax Free In 2021 Tax Free Savings Save Money Easy Saving Money

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

Child Tax Credit United States Wikipedia

Startup 401k Tax Credits Bauman Noonan And Associates Tax Credits Start Up Noonan

Reverse Charge Mechanism Rcm Under Goods In 2020 Paying Taxes Types Of Taxes Tax Credits

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Tax Rebate Digital Tax Filing Taxes Tax Services

New Itep Estimates On Biden S Proposal To Expand The Child Tax Credit Itep

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

Sept 30 Is Last Date For Filing Ay 2019 20 Itr What You Need To Keep In Mind Tax Refund Filing Taxes Income Tax Return

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance Tax Table Irs Taxes Tax Brackets

My Portfolio August And September Month Analysys How I Trade How To Manage Your Portfolio Youtube Portfolio September August

Power Grab Denied Gas Tax Power Climate Action

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities